fiduciary investment management services

discipline

Should I invest myself or hire an expert? If I decide to hire a registered investment advisor, how do I go about the selection process?

diversification

Will a fiduciary investment advisor help me divvy up my investments among different types of assets, accounts, investment strategies, and investment vehicles? How much risk should I assume?

minimizing costs

Can a investment advisor help me minimize fees, trading and custodial costs, and taxes that ultimately reduce my investment returns?

investment process

personal situation

define goals, time horizon, and risk tolerance.

broad asset allocation

among primary asset classes: cash, fixed income, equities and alternatives.

sub-asset allocation

within primary asset classes, such as domestic or international.

asset location

determined by allocation of investments among taxable and tax-advantaged accounts.

investment vehicle selection

using mutual funds, exchange-traded funds, and separately managed accounts to own passive and active strategies.

monitoring

quarterly performance reporting, rebalancing, and tax loss harvesting.

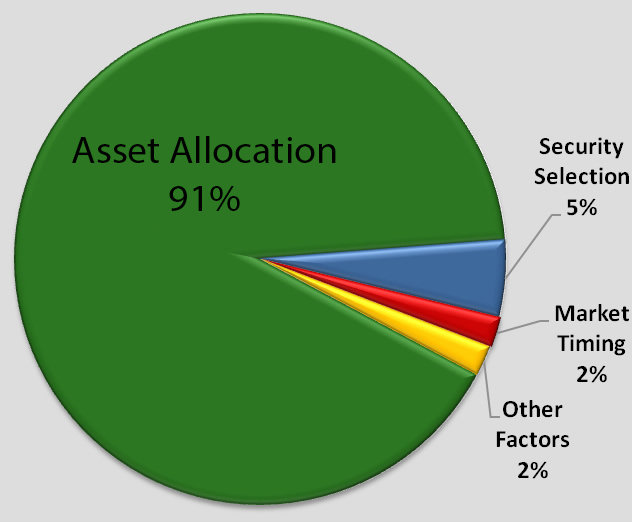

Studies have shown the selection of a portfolio’s asset allocation can be responsible for over 90% of a portfolio’s variance, with the remaining portion comprised of market timing, security selection, and other factors.

Source: Brinson, Singer and Beebower, “Determinants of Portfolio Performance,” Financial Analyst Journal, May–June 1991.